E-Commerce Notes

Unit-2

Lecture-1

Security Issues in E-Commerce Transactions

Ø

Authentication:- Authentication

ensures that the origin of an electronic message is correctly identified. This

means having the capability to determine who sent the message and from where or

which machine. Without proper authentication, it will be impossible to know who

actually placed an order and whether the order placed is genuine or not.

Ø Non-Repudiation:- Non-Repudiation is closely related to

authentication and this ensures that the sender cannot deny sending a

particular message and the receiver cannot deny receiving a message.

Ø Access Control:- If access control is properly implemented, many other

security problems like lack of privacy will either be eliminated or mitigated. Access

control ensures only those that legitimately require accesses to resources are

given access and those without valid access cannot have access.

Ø Confidentiality or Privacy:- Privacy ensures that only authorized

parties can access information in any system. The information should not be

distributed to parties that should not receive it. Issues related to privacy

can be considered as a subset of issues related to access control.

Ø

Integrity:- Integrity ensures that only

authorized parties can make changes to the documents transmitted over the

network.

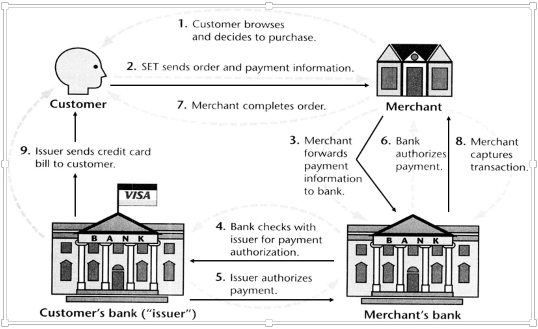

Secure Electronic Transaction (SET)

v

Secure

Electronic Transaction (SET) is an open protocol which has the potential to

emerge as a dominant force in the security of electronic transactions.

v Jointly developed by Visa and

MasterCard, in conjunction with leading computer vendors such as IBM,

Microsoft, Netscape RSA, and GTE.

v

SET

is an open standard protocol for protecting the privacy and ensuring the authenticity

of electronic transactions.

§ Provide confidentiality of payment

and ordering information.

§ Ensure the integrity of all

transmitted data.

§ Provide authentication that a card

holder is a legitimate user of a credit card account.

§ Provide authentication that a

merchant can accept credit card transactions through its relationship with a

financial institution.

§ Ensure the use of best security

practices and system design techniques to protect all legitimate parties in an

electronic commerce transaction.

§ Create a protocol that neither

depends on transport security mechanisms nor prevents their use.

§ Facilitate and encourage

interoperability among software & network providers.

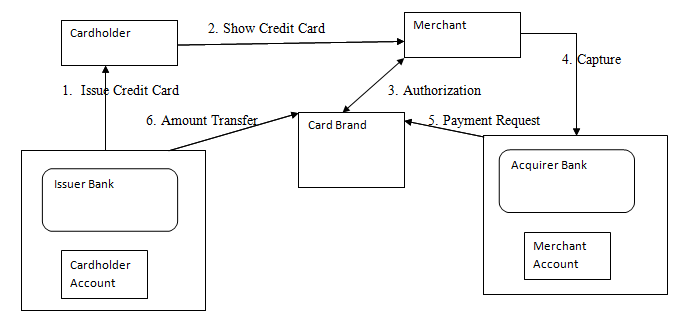

Participants in the SET system

Scope of SET

1.

Motivated

by the large amount of unsecured credit-card based transactions on the

Internet.

2.

Network

payments treated in a similar way to Mail Order/Telephone Order (MOTO)

transactions.

3.

SET

applies only to the ‘front end’ of payment no need to change the ‘back end’.

4.

SET

only addresses Payment - other protocols for shopping, payment method selection

etc. will be developed by others.

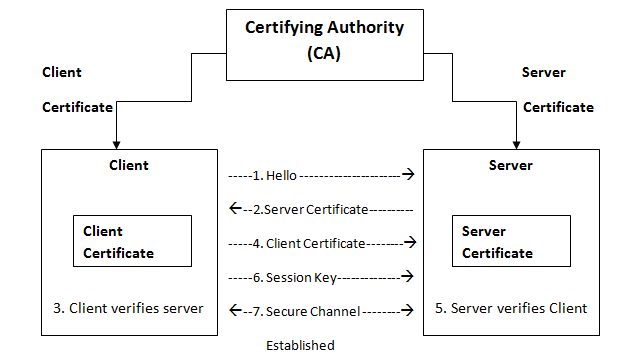

Secure Socket Layer (SSL)

v SSL is a protocol developed by

Netscape for transmitting private documents via the Internet.

v SSL uses cryptographic system that

uses two keys to encrypt data a public key known to everyone and a private or

secret key known only to the recipient of the message.

v The SSL provides end-to-end secure

data transmission between the web server and the web client.

v It is sandwiched between the TCP/IP

and the application layer.

v

Unlike

TCP/IP that offers only reliable packet transfer, SSL ensures secure packet

transfer.

How SSL works?

The SSL performs two functions-it

authenticates the websites and ensures secure data transmission between the web

server and the client.

It achieves this either by using

symmetric encryption or asymmetric encryption.

In symmetric encryption, a key called the private key is used

both for encrypting and decrypting the data. For symmetric encryption to work, the

sender & receiver should share the private key. This is possible only when

the sender & receiver know each other.

In asymmetric encryption, two separate keys are used to encrypt

& decrypt data. The public key is shared with the other person and the private

key is known only to the person who decrypts the data. So, the private key will

remain a secret while the public key will be known to both the parties.

E-Commerce Notes

Unit-2

Lecture-2

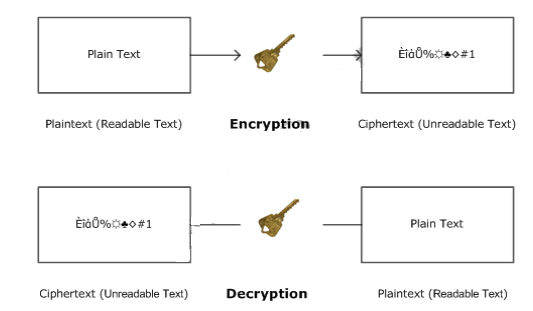

Cryptography

Cryptography is the process through

which the messages are altered so that their meaning is hidden from adversaries

who might intercept them.

Plain text is a message readable by anyone. Cipher text is plain text that has been modified to protect

its secrecy.

Encryption converts plain text to cipher text; Decryption converts cipher text to plain text.

“Cryptography

addresses the principles, means and methods used to disguise information in

order to ensure its authenticity”.

Cryptography is used to achieve:-

·

Confidentiality:

only authorized persons can access information.

·

Integrity:

information that was sent is what was received.

·

Authentication:

guarantee of originator of electronic transmission.

·

Non-repudiation:

originator of information cannot deny content or transmission.

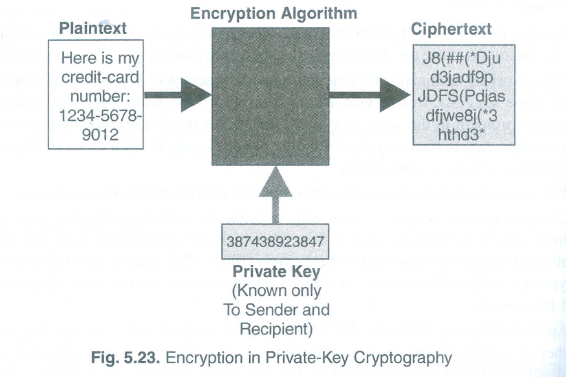

Types of Cryptography:-

Ø Private Key Cryptography

Ø Public Key Cryptography

Private Key Cryptography

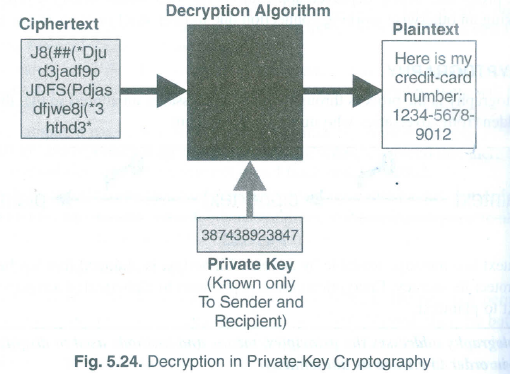

In private-key cryptography, the

sender and receiver agree beforehand on a secret private key. The plain text is

somewhat combined with the key to create the cipher text. The method of

combination is such that, it is hoped, an adversary could not determine the

meaning of the message without decrypting the message, for which he needs the

key.

Private-key methods are efficient and

difficult to break. However, one major drawback is that the key must be

exchanged between the sender and recipient beforehand, raising the issue of how

to protect the secrecy of the key.

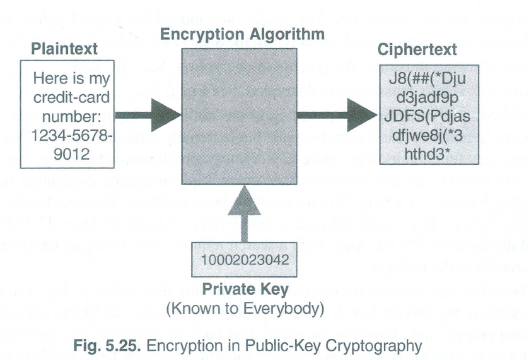

Public Key Cryptography

In public-key cryptography, two

separate keys are used to encrypt & decrypt data. The public key is shared

with the other person and the private key is known only to the person who

decrypts the data. So, the private key will remain a secret while the public

key will be known to both the parties.

Public-key cryptography depends upon

the notion of one-way functions: a one way function is a function that is easy

to apply, but extremely difficult to invert.

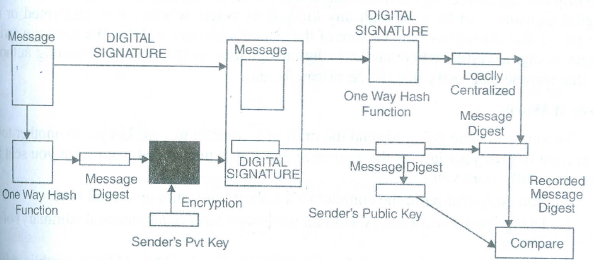

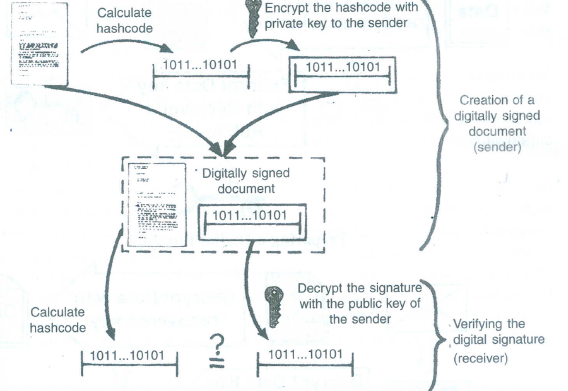

Digital Signature

A digital signature is an electronic

signature that can be used to authenticate the identity of the sender of a

message or the signer of a document, and possibly to ensure that the original

content of the message or document that has been sent is unchanged.

“Digital

signature is a computer data compilation of any symbol or series of symbols,

executed, adopted or authorized by an individual to be legally binded

equivalent to the individual’s handwritten signature”

v A digital signature authenticates

electronic documents in a similar manner a handwritten signature authenticates

printed documents.

v A digital signature is issued by a

Certification Authority (CA) and is signed with the CA’s private key.

v The recipient of a digitally signed

message can verify that the message originated from the person whose signature

is attached to the document and that the message has not been altered either

intentionally or accidentally since it was signed. Also the signer of a

document cannot later disown it by claiming that the signature was forged.

v When a message with a digital

signature is transmitted & received, the following parties are involved:-

Ø The signer who signs the document.

Ø The verifier who receives the signed

document & verifies the signature.

Ø The arbitrator who arbitrates any

disputes between the signer & the verifier if there is a disagreement on

the validity of the digital signature.

v A digital signature typically contains

the Owner’s public key, the Owner’s name, Expiration date of the public key,

the name of the issuer (the CA that issued the Digital ID), Serial no. of the

digital signature and the digital signature of the issuer.

v Digital signatures are based on a

combination of public key encryption and one way hash function that converts a

message of any length into a fixed length message digest known as hash

function. The value of hash function is unique for the hashed data. Any change

in the data, even deleting or altering a single character, results in a

different value. The content of the hash data cannot be deduced from hash which

is why it is called ‘one way’. The encrypted hash, along with other

information, such as hashing algorithm is known as digital signature.

E-Commerce Notes

Unit-2

Lecture-3

Virtual Private Network

Ø

A

Virtual private network (VPN) extends a private network across a public

network, such as the internet.

Ø It enables a computer to send and

receive data across shared or public networks as if it were directly connected

to the private network.

Ø This is done by establishing a

virtual point-to-point connection through the use of dedicated connections,

encryption or a combination of the two.

Ø VPN allows employees to securely

access their company’s intranet while travelling outside the office.

Ø Similarly, VPNs securely and cost

effectively connect geographically disparate offices of an organization,

creating one cohesive virtual network.

Ø

VPN

technology is also used by ordinary Internet users to connect to proxy servers

for the purpose of protecting one’s identity.

Types of VPN:

·

Remote

Access VPN

·

Site-to-Site

VPN

Ø Remote Access VPN:- Remote access VPNs allow employees to access their

company’s intranet from home or while travelling outside the office.

Ø Site-to-Site VPN:- Site-to-Site VPN allow employees in geographically

disparate offices to share on cohesive virtual network.

VPN systems may be classified by:-

·

The

protocols used to tunnel the traffic.

·

The

tunnel’s termination point location.

·

Whether

they offer site-to-site or remote access connectivity.

·

The

level of security provided.

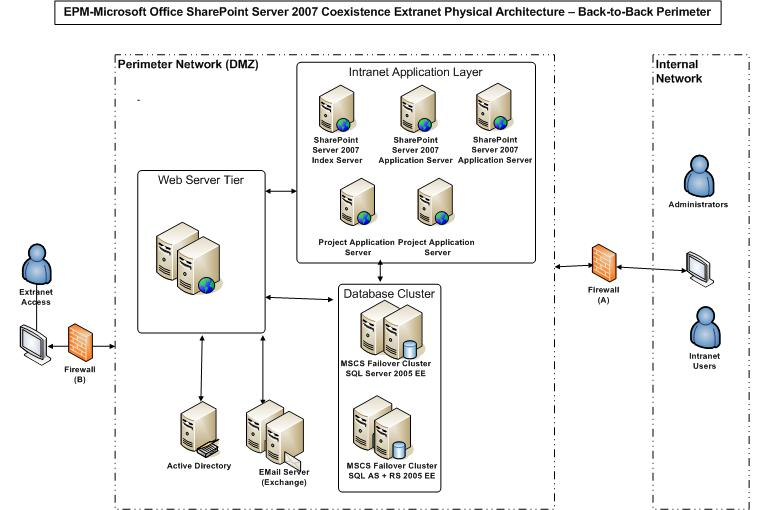

VPN Architecture

There are two basic VPN architectural

choices:-

Ø Service provider independent VPN

Ø Service provider dependent VPN

·

Service provider independent VPN:- In a service provider independent

solution, a VPN enabled client(such as a desktop or laptop) initiates the

tunnel through the public network to the central site. To access the computer

network, the client first establishes a PPP (Point-to-Point protocol) session

to a local Internet Service Provider (ISP) for internet access. The client then

connects across the Internet to the central site and establishes a tunnel to

carry the data traffic. To the ISP the tunnel is simply data, and there is no

requirement for processing.

Advantage:

The advantage to the corporation is that it can use

any Point of Presence (POP) anywhere in the world, as long as it provides

Internet access. In addition, since the tunnel is initiated at the location of

the client, the client can travel with the same ease as carrying a laptop.

Disadvantage:

The disadvantage of this solution is that the client

must be VPN enabled. This could be prohibitively expensive to deploy for a

large no. of remote users.

·

Service provider dependent VPN:- With a service provider dependent

VPN model, the corporation enters into an agreement with a service provider

such as an ISP. The corporation user dials into a local POP with a PPP client,

and the tunnel session is initiated at the POP. The crucial difference is that

the client can be any PPP client.

Advantage

This arrangement can be combined with quality of

service agreements to guarantee a level of VPN performance, although few

service providers offers true guarantees today. Another advantage is that no

additional skills are required by the user to execute a tunnel to the company

LAN.

Disadvantage

Data security is critical because VPN encryption does

not occur until the POP, thus leaving the enterprise communication unprotected

between the remote PC and the POP.

VPN Security

v To prevent disclosure of private

information, VPNs typically allow only authenticated remote access and make use

of encryption techniques. VPN provides security by the use of tunneling

products and through security procedures such as encryption.

v The VPN security provides:

·

Confidentiality

·

Authentication

·

Integrity

v VPNs ensure privacy by providing a

private tunnel through the internet for remote access to the network. For full

VPN security, your VPN must be enhanced with a reliable user authentication

mechanism, protecting end points of the VPN.

v Username and password authentication

is not enough-this method is weak and highly susceptible to hacking, cracking,

key loggers and other attacks. It only takes one compromised password for your

organization to lose control over gains network access. Strong user authentication

with a VPN provides true secure remote access for today’s mobile workforce.

E-Commerce Notes

Unit-2

Lecture-4

Types of Security Attacks

v Passive Attack

v Active Attack

Ø Passive Attack: In Passive attack a network intruder

intercepts data travelling through the network. A passive attack monitors

unencrypted traffic. Passive attacks include traffic analysis, monitoring of

unprotected communications, capturing authentication information such as

passwords.

Types of Passive

Attacks:

a)

Wire Tapping or Telephone Tapping: Telephone tapping is the monitoring

of telephone and internet conversations by a third party. Passive wire tapping

monitors or records the traffic.

b)

Port Scanner: A port scan can be defined as an

attack that sends client requests to a range of server port addresses on a

host, with a goal of finding an active port and exploiting a known

vulnerability of that service.

c)

Idle Scan: The idle scan is a TCP port scan

method that consists of sending spoofed packets to a computer to find out what

services are available. This is accomplished by impersonating another computer

called a “zombie” and observing the behavior of the “zombie” system.

Ø Active Attack: In active attacks intruder initiates commands to disrupt

the network’s normal operation. In an active attack, the attacker tries to

bypass or break into secured systems. This can be done through viruses or

worms. Active attacks include attempts to break protection features to introduce

malicious code, and to steal or modify information.

Types of Active

Attacks

a)

Denial-of-service Attack (Dos): Denial of service attack is an

attempt to make a machine or network resources unavailable to its intended

users. It generally consists of efforts to temporarily or indefinitely

interrupt or suspend services of a host connected to the Internet. One common

method of attack involves saturating the target machine with external

communication requests, so much so that it cannot respond to legitimate traffic

or responds so quickly as to be rendered essentially unavailable. Such attacks

usually lead to a server overload.

b)

Spoofing attack: A spoofing attack is when a

malicious party impersonates another device or user on a network in order to

launch attacks against network hosts , steal data, spread malware or bypass

access controls.

c)

Man-in-the-middle attack: The man-in-the middle is a form of

active eves dropping in which the attacker makes independent connections with

the victims & relays messages between them, making them believe that they

are talking directly to each other over a private connection, while in fact the

entire conversation is controlled by the attacker. The attacker must be able to

intercept all messages going between the two victims & inject new ones.

d)

SQL injection: Sql injection is a code injection

technique, used to attack data driven applications, in which malicious SQL

statements are inserted into an entry field for execution.

Difference between Computer Virus and Computer Worm

Sno.

|

Computer

Virus

|

Computer

Worm

|

1.

|

It cannot be

controlled remotely.

|

It can be controlled remotely.

|

2.

|

It deletes,

modifies the files and also change the location of file.

|

It only monopolies the CPU & memory.

|

3.

|

It is slower

than worm

|

Worm is faster than virus.

|

4.

|

The virus is

the program code that attaches itself to application program and when

application program run it runs along with it.

|

The worm is code that replicate itself in order to

consume resources to bring it down.

|

E-Commerce Notes

Unit-2

Lecture-5

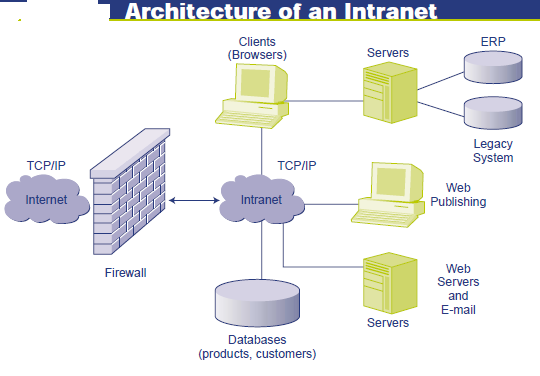

Intranet

Intranet Software enables an organization to securely share it's information

or operations with it's members. It enables the efficient use and more

importantly reuse of an organization's gathered business knowledge and

intelligence, which increases productivity and knowledge transfer in any

organization. Increasingly, extranets are also coming into use, where external

partners, customers can also interact with an organization. E.g. ERP software

that provides a centralized repository of information for massive amount of transaction

and details generated daily.

The cost of converting an existing client-server network to

an intranet is relatively low, especially when a company is already using the

Internet.

Applications of Intranet:

The most popular intranet application is obviously:

1.

Inter-office e-mail, this capability allows

the employees of a company to communicate with each other swiftly and easily.

If the intranet has access to the Internet, e-mail can be accessed through the

Internet connection. If the intranet is running without the Internet, special

e-mail software packages can be bought and installed so that employees can take

advantage of its many benefits.

2.

An

intranet has many other different applications that can be utilized by a

company. These include the Web publishing of corporate documents, Web forms,

and Web-to-database links that allow users to access information.

3.

Newsletters,

information on benefits, job listings and classifieds, libraries, stock quotes,

maps, historical data, catalogs, price lists, information on competitors'

products, and customer service data are just a few examples of these types of

applications.

In

addition, there are several other main applications that is very popular in the

intranet format:-

1.

Document publication applications

The first application that

always comes to mind for intranets in and of themselves is the publication and

distribution of documents. This application allows for paperless publication of

any business information that is needed for internal employees or external customers

or suppliers. Any type of document may be published on an intranet: policy and

procedure manuals, employee benefits, software user guides, online help,

training manuals, vacancy announcements--the list goes on to include any

company documentation.

2.

Electronic resources applications

In the past it has not been

easy to share electronic resources across network nodes. Employees have had

problems sharing information for various reasons including software version

inaccuracies and incompatibilities. Intranets provide the means to catalog resources

online for easy deployment across the network to any authorized user with the

click of a mouse. Software applications, templates, and tools are easily

downloaded to any machine on the network.

3.

Interactive communication applications

Two-way communications and

collaboration on projects, papers, and topics of interest become easy across

the intranet. Types of communications that are enhanced and facilitated include

e-mail, group document review, and use of groupware for developing new

products.

4.

Support for Internet applications

Even though organizational

full-service intranets are the next step in enterprise-wide computing and have

enough value to make them desirable simply for the organizational benefits they

bring, they are also necessary for supporting any Internet applications that

are built.

The transactional processes and trading of information that will be done by all but the most elementary Web applications will require an infrastructure to store, move, and make use of the information that is traded. The infrastructure to accomplish those tasks is the organizational intranet.

The transactional processes and trading of information that will be done by all but the most elementary Web applications will require an infrastructure to store, move, and make use of the information that is traded. The infrastructure to accomplish those tasks is the organizational intranet.

Generic Functions of Intranet:

Major generic functions that intranet

can provide are:

·

Corporate/ department/ individual WebPages: Access the web- pages of corporate, departments and

individual.

·

Database access:

Web- based database.

·

Search engines and directories: It assists the keyword- based search.

·

Interactive communication: chatting, audio and videoconference.

·

Document distribution and workflow: web- based download and routing of documents.

·

Groupware:

E-mail and bulletin board.

·

Telephony:

intranet is the perfect conduit for computer-based telephony.

·

Extranet:

linking geographically dispersed branches, customers and suppliers to

authorized sections of intranets creates happiest customers, more efficient

suppliers, and reduced staff cost.

Considerations in Intranet Deployment:

1.

Collections of

web links

2.

Company news and

department newsletters

3.

Organization

charts

4.

Manuals, documentation,

policies

5.

Basic

collaboration tools (groupware)

6.

Directory

services (gateway to phone and other staff contact info)

7.

Human resources

information

8.

Threaded

discussions on current company topics/issues

9.

Web–based email

access

10.

Web–based

discussion list management and participation

11.

Access to company

databases — sales, inventory, pricing

12.

Calendaring

(company–wide events calendar)

13.

Scheduling

(meetings, personal scheduling)

14.

Document

management

15.

Search engine of

company documents

16.

Employee time

logging

17.

Employee expense

reporting

18.

Forms to help

automate other business processes – work

orders, job descriptions, mileage, maintenance requests, etc.

Intranet Application Case Studies:

Now, let us investigate some typical

application case in depth, including their return on investment (ROI).

Intranet Case studies with ROI Analysis:

The need for accountability and for

clear measures of success is increasingly demanded for all corporate

expenditures, including intranets. If you are responsible for an intranet, you

need to know how build a business case and develop a return on investment (ROI)

strategy.

Intranet ROI

Intranets and corporate portals are expensive

endeavors. Despite the expense, many organizations understand the implicit

and/or explicit value. Intranets are widely valued for:

- Streamlining

business processes and driving operational efficiencies

- Significantly

reducing cost of internal business functions

- Enhancing

communications and collaboration between employees, managers, suppliers

and partners

As with any critical business system, an

intranet or portal must be delivering measurable performance and remain

accountable to the investment. If the site’s value is not being measured, then

it risks failing the needs and demands of employees and management.

When asked how executives determine whether an

intranet or portal is delivering value, they typically point to reducing costs

and improving productivity.

Of course, IT budgets are increasingly tied to

company-wide business and strategic initiatives. The cost justification for any

expenditure, including IT must have a clear bottom line that answers the

question, “What’s the payback?”

In recent years, business challenges and

subsequent solutions/applications have been the driving force behind intranet

investments. They will continue to play this role in the future.

Executives will make investments in intranets

and portals (see defining in the adjacent glossary) if such investments spur

growth, cut the cost of operations, and/or help enhance the customer experience

(retaining and building the customer base).

The challenging economic climate of the past

few years means that more and more organizations will allocate dollars to IT

systems and applications that can demonstrate a measured solution and ROI to a

business problem or provide enhanced service and growth.

Short

Intranet Application Cases

Prescient Digital Media is a veteran web and

intranet consulting firm. It provides strategic Internet and intranet

consulting, planning and design services to many Fortune 500 and big brand

clients, as well as small and medium-sized leaders. It treat each client as

unique; It listen to their needs, goals

and challenges; understand a client's requirements and potential; and deliver

highly effective and innovative website and intranet plans, designs and

solutions.

ROI Study Of the respondents to the

Prescient Digital Media ROI survey that undertake ‘rough estimates’

of their organization’s intranet, answers varied from $0 to $20M. The

average annual ROI of respondent intranets fell just shy of $1

million ($979,775.58).

While less than 20% of organizations have

measured specific benefits, a majority of organizations have at the very least

made a ‘rough estimate’ or guess of the value of their ROI. While only a

handful of technology companies measured intranet ROI three years ago, there

are encouraging signs of change. A recent study, conducted by Prescient Digital

Media Ltd., finds that 6% of organizations undertake ongoing, specific

measurement of the ROI of their intranet. Occasional measurement is undertaken

by 26% of the respondent organizations.

While extensive ROI measurement has not yet

become mandatory at a majority of organizations with intranets, ROI is a

priority in 76% of the survey respondents. Rather than attempt to measure the

intranet or portal’s entire value, those companies that are successfully

gauging value are measuring specific benefits. This paper lists intranet

benefits in 10 key categories – including hard costs, increased revenue, etc. –

with two supporting categories: content management and procurement.

The precision, scope of work and execution

required to build and maintain a successful intranet or portal is massive –

from governance to content management, and from technology to business

processes. At the heart of a successful intranet is the strength of the

underlying plan. Failure to develop an integrated plan that accounts for an

organization’s structure, stakeholder, and user requirements will almost

certainly ensure failure and, with it, a loss of significant time, money and

jobs.

Finally, while appraising the ROI of an

intranet or portal is critical for most executives, there exists a great deal

of untapped, intangible value that is perhaps even more critical than the

measured dollars and cents. When properly deployed, intranets improve

communication and collaboration and improve employee satisfaction, which in

turn can improve productivity. All benefits are clearly important to any

organization, but not always a measurable ROI.

Share

Knowledge Among Corporate Employee

Intranets offer several facilities that aid

knowledge sharing:

Easy-to-access

and use: The use

of World Wide Web (WWW) browsers give a low cost and easy-to-use interface to

information and applications

Universal

access to information:

Information can be kept on any 'server' on the network, and can be accessed

from anywhere within the Intranet.

Person-to-person

interaction:

Intranets simplify interaction between people in different locations, through

electronic mail, and computer conferencing

Informal

networks:

Publishing information and making contact is quick and informal on an Intranet.

Scalable

networks: As

organizations restructure, it is easy to add or remove servers to the overall

network.

Access

to external information and knowledge:

Intranets usually have gateways to the external Internet, which give access to

a rapidly growing global information resource

E-Commerce Notes

Unit-2

Lecture-6

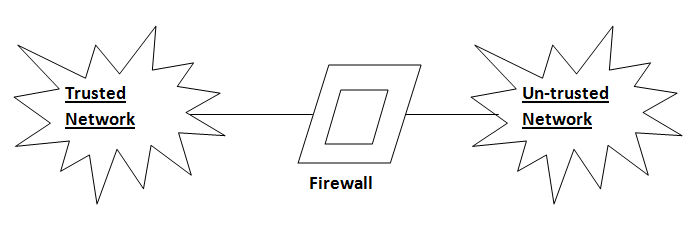

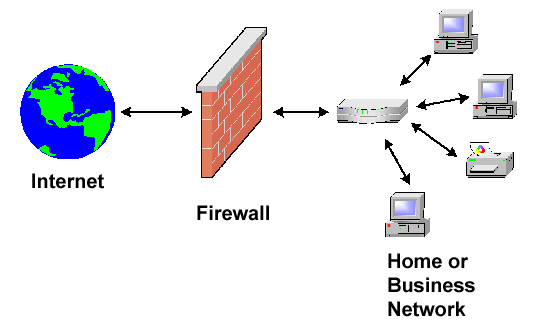

Firewall

v Firewall is software or hardware

based network security system that controls the incoming and outgoing network

traffic by analyzing the data packets and determining whether they should be

allowed through or not, based on a rule set.

v A firewall establishes a human

barrier between a trusted, secure internal network & another network that

is not assumed to be secure and trusted.

v Many personal computer operating

systems include software-based firewalls to protect against threats from the

public Internet. Many routers that pass data between networks contain firewall

components and conversely many firewalls can perform basic routing functions.

Types of Firewall

Ø Network Layer or Packet Filters

Firewall

Ø Application Layer Firewall

Ø Proxy Firewall

Ø Unified Threat Management(UTM)

Network Layer or Packet Filters Firewalls

Network layer firewalls, also called

packet filters, operate at a relatively low level of the TCP/IP protocol stack,

not allowing packets to pass through the firewall unless they match the

established rule set.

A simple router is the traditional

network layer firewall, since it is not able to make particularly complicated

decisions about what a packet is actually taking to or where it actually came

from. Modern network layer firewalls have become increasingly more sophisticated

& now maintain internal information about the state of connections passing

through them at any time.

Application Layer Firewalls

Application layer firewalls work on

the application level of the TCP/IP stack, and may intercept all packets traveling

to or from an application. They block other packets (usually dropping them

without acknowledgement to the sender).

On inspecting all packets for proper

content, firewalls can restrict or prevent outright the spread of networked

computer worms and Trojans.

Proxy Firewalls

Proxy firewalls offer more security

than other types of firewalls. Unlike application layer firewalls which allow

or block network packets from passing to and from a protected network, traffic

does not flow through proxy. Instead computers establish a connection to the

proxy which serves as an intermediary and initiate a network connection on

behalf of the request. This prevents direct connections between systems on

either side of the firewall and makes it harder for an attacker to discover

where the network is, because they will never receive packets created directly

by their target system.

Unified Threat Management

A product category called unified

threat management (UTM) has emerged. These device promise integration,

convenience & protection from pretty much every threat out there and are

especially valuable to small & medium-sized businesses.

Unified Threat Management is a

firewall appliance that not only guards against intrusion but performs content

filtering, spam filtering, intrusion detection & anti-virus duties

traditionally handled by multiple systems. These devices are assigned to combat

all levels of malicious activity on the computer network.

E-Commerce Notes

Unit-2

Lecture-7

Electronic Payment Systems

Electronic Payment is a financial

exchange that takes place online between buyers and sellers. The content of

this exchange is usually some form of digital financial instrument (such as encrypted

credit card numbers, electronic cheques or digital cash) that is backed by a

bank or an intermediary, or by a legal tender.

The

various factors that have lead the financial institutions to make use of

electronic payments are:

1. Decreasing

technology cost:

The technology used in the networks is decreasing day

by day, which is evident from the fact that computers are now dirt-cheap and

Internet is becoming free almost everywhere in the world.

2. Reduced

operational and processing cost:

Due to reduced technology cost the processing cost of

various commerce activities becomes very less. A very simple reason to prove

this is the fact that in electronic transactions we save both paper and time.

3. Increasing

online commerce:

The above two factors have lead many institutions

to go online and many others are following them.

There are

also many problems with the traditional payment systems that are leading to its

fade out. Some of them are enumerated below:

1. Lack of

Convenience:

Traditional payment systems require the

consumer to either send paper cheques by snail-mail or require him/her to

physically come over and sign papers before performing a transaction. This may

lead to annoying circumstances sometimes.

2. Lack of

Security:

This is because the consumer has to send

all confidential data on a paper, which is not encrypted, that too by post

where it may be read by anyone.

3. Lack of

Coverage:

When we talk in terms of current

businesses, they span many countries or states. These business houses need

faster transactions everywhere. This is not possible without the bank having

branch near all of the company’s offices. This statement is self-explanatory.

4. Lack of

Eligibility:

Not all potential buyers may have a bank

account.

5. Lack of

support for micro-transactions:

Many transactions done on the Internet

are of very low cost though they involve data flow between two entities in two

countries. The same if done on paper may not be feasible at all.

Types of

Electronic Payment System

1.

Electronic Tokens

An electronic token is a digital analog of various

forms of payment backed by a bank or financial institution. There are two types

of tokens:

·

Real Time: (or Pre-paid tokens) - These are exchanged between buyer and seller, their

users pre-pay for tokens that serve as currency. Transactions are settled with

the exchange of these tokens. Examples of these are DigiCash, Debit Cards,

Electronic purse etc.

·

Post Paid Tokens – are used with fund transfer instructions between the buyer and

seller. Examples – Electronic cheques, Credit cards etc.

2.

Credit Cards

·

A

credit card is a small plastic card issued to users as a system of payment.

·

It

allows its holders to buy goods & services based on the holder’s promise to

pay for these goods and services.

·

Essentially

a credit card allows you to:-

Ø Purchase products or services

whenever and wherever you want, without ready cash and paying for them at a

later date.

Ø Have an option of paying only a part

of the total expenses. The balance amount can be carried forward, with an

interest charged.

Ø Enjoying a revolving credit limit

without any charges for a limited period (mostly 20 to 50 days).

Types of Credit Cards

1.

Standard Credit Card: The most common type of credit card

allows you to have a revolving balance up to a certain credit limit. These

credit cards have a minimum payment that must be paid by a certain due date to

avoid late payments.

2.

Premium Credit Cards: These cards offer incentives and

benefits beyond that of a regular credit card. Examples of premium credit cards

are gold and platinum cards that offer cash back, reward points, travel

upgrades and other rewards to cardholders.

3.

Charge Cards: Charge cards do not have a credit

limit. The balance on a charge card must be paid in full at the end of each

month. Charge cards do not have a minimum payment since the balance is to be

paid in full. Late payments are subject to a fee, charge restrictions, or card

cancellation depending on your card agreement.

4.

Limited Purpose Card: Limited purpose credit cards can

only be used at specific locations. Limited purpose cards are used like credit

cards with a minimum payment & finance charge. Store credit cards & gas

credit cards are examples of limited purpose credit cards.

5.

Secured Credit Card: Secured credit cards are an option

for those without a credit history or those with blemished credit. Secured

cards require a security deposit to be placed on the card. The credit limit on

a secured credit card is equal to the amount of the deposit made.

6.

Prepaid Credit Card: Prepaid credit cards require the

cardholder to load money onto the card before the card can be used. The credit

limit does not renew until more money is loaded onto the card. Prepaid cards

are similar to debit cards, but are not tied to a checking account.

7.

Business credit card: Business credit cards are designed

specifically for business use. They provide owners with an easy method of

keeping business & personal transactions separate.

The Players

Before exploring the

process of using credit card online, let’s identify the players in the credit

card system. They are:

The card holder: a consumer or a corporate purchaser who uses credit cards to pay

merchant.

The merchant: the entity that accept credit cards and offers goods or services in

exchange for payments.

The card issuer: a financial institution (usually a bank) that establishes accounts

for cardholders and issues credit cards.

The acquirer: a financial institution (usually a bank) that establishes accounts

for merchants and acquires the vouchers of authorized sales slip.

The card brand: bank card associations of issuers acquires ( like Visa and

MasterCard) which are created to protect and advertise the card brand,

establish and enforce rules for use and acceptance of their bank cards and

provide networks to connect the involved financial institutions. The brand

authorizes the credit- based transaction and guarantees the payment to

merchants. Sometimes the issuing bank performs the business of the brand.

The process of using credit card:

1.

Issue a

credit card to a potential card holder.

2.

The

cardholder shows the card to a merchant whenever he/she needs to pay for a

product or services.

3.

The merchant

then asks for approval from the brand company, and the transaction is paid by

the credit. The merchant keeps a sales slip.

4.

The merchant

sells the slip to the acquiring bank and pays a fee for the service. This is

called the capturing process.

6.

The amount is transferred

from issuer to brand. The same amount is deducted from the cardholder’s account

in the issuing bank.

Advantages of Credit Cards:

Ø They allow you to make purchases on

credit without carrying around a lot of cash.

Ø They allow convenient remote

purchasing ordering/shopping online or by phone.

Ø They allow you to pay for large

purchases in small, monthly installments.

Ø Many cards offer additional benefits

such as additional insurance cover on purchases, cash back, air miles &

discounts on holidays.

Ø

Under

certain circumstances, they allow you to withhold payment for merchandise which

proves defective.

Disadvantages of Credit Cards:

Ø

You

may become an impulsive buyer and tend to overspend because of the ease of

using credit cards. Cards can encourage the purchasing of goods & services

you cannot really afford.

Ø Lost or stolen cards may result in

some unwanted expense & inconvenience.

Ø The use of large no. of credit cards

can get you even further into debt.

Ø

Using

a credit card especially remotely introduces an element of risk as the card

details may fall into the wrong hands resulting in fraudulent purchases on the

cards. Fraudulent or unauthorized charges may take months to dispute,

investigate and resolve.

3.

Smart Cards

Ø A smart card is a plastic card about

the size of a credit card, with an embedded microchip that can be loaded with

data.

Ø Smart cards are made of plastics generally

polyvinyl chloride.

Ø Smart cards can provide

identification, authentication, data storage & application processing.

Ø A smart card contains more

information than a magnetic strip card and it can be programmed for different

applications.

Ø Smart cards within the next five

years will be the industry standard in debit and credit cards. As the major

high street banks and finance houses are now investing in the changeover to

smart card technology.

Ø You may use a smart card to:-

·

Establish

your identity when logging on to an Internet access provider or to an online

bank.

·

Pay

for parking at parking meters or to get on subways, trains or buses.

·

Give

hospitals or doctors personal data without filling out a form.

·

Make

small purchases at electronic stores on the web.

Advantages of Smart Cards:

§ Greater Reliability

§ Storage Capacity is increased up to

100 times.

§ Smart cards are multifunctional.

§ The anticipated working life of a

smart card is ten years compared to that of a magnetic strip card.

4. Electronic Cheques

The electronic cheques are modeled on paper cheques,

except that they are initialted electronically.

They use digital signatures for signing and endorsing

and require the use of digital certificates to authenticate the payer, the

payer’s bank and bank account.

Electronic checks allow merchants to convert paper

check payments made by customers to electronic payments that are processed

through the Automated Clearing House

(ACH).

How Electronic

Cheques work:

When you receive a paper cheque payment from your customer

, you will run the cheque through an electronic scanner system supplied by your

merchant service provider. This virtual terminal captures the customer’s

banking information and payment amount written on the cheque. The information

is transferred electronically via the Federal Reserve Bank’s ACH Network, which

takes the funds from your customer’s account & deposits them to yours.

Once the cheque has been processed & approved, the

virtual terminal will instantly print a receipt for the customer to sign &

keep.

Benefits of

Electronic Cheques:

·

Secure

and quick settlement of financial obligations.

·

Fast

cheque processing

·

Very

low transaction cost.

5.

Electronic or Digital Cash

A system that allows a person to pay for

goods or services by transmitting a number from one computer to another.

Like the serial numbers on real dollar

bills, the digital cash numbers are unique. Each one is issued by a bank &

represents a specified sum of money.

Digital Cash combines computerized

convenience with security and privacy that improve upon paper cash. Cash is

still the dominant form of payment as: The consumer still mistrusts the banks.

The non-cash transactions are inefficiently cleared. In addition, due to

negative real interests rates on bank deposits.

Digital cash is based on cryptographic

systems called "Digital Signatures" similar to the signatures used by

banks on paper cheques to authenticate a customer.

Some qualities

of cash:

a. Cash is a legal tender i.e. payee is obligatory to

take it.

b. It is negotiable i.e. can be given or traded to

someone else.

c.

It is a bearer

instrument i.e. possession is proof of ownership.

d. It can be held & used by anyone, even those

without a bank certificate.

e. It places no risk on part of acceptor.

The following are the limitations of

Debit and Credit Cards:

i.

They are

identification cards owned by the issuer & restricted to one user i.e.

cannot be given away.

ii.

They are not

legal tender

iii.

Their usage

requires an account relationship and authorization system.

Properties

of Digital Cash

o Must have a monetary value: It must be backed by cash (currency), bank authorized

credit or a bank certified cashier’s check.

o Must be interoperable or exchangeable: as payment for other digital cash, paper cash, goods

or services, lines of credit, bank notes or obligations, electronic benefit

transfers and the like.

o Must be storable and retrievable: Cash could be stored on a remote computer’s memory,

in smart cards, or on other easily transported standard or special purpose

devices. Remote storage or retrieval would allow users to exchange digital cash

from home or office or while traveling.

6.

Debit Cards

A debit card is a plastic payment card that provides

the cardholder electronic access to his or her bank account at a financial

institution.

Types of Debit Card Systems:

·

Online

Debit or Pin Debit

·

Offline

Debit or Signature Debit

Online Debit System: Online debit system requires

electronic authorization of every transaction and the debits are reflected in

the user’s account immediately. The transaction may be secured with the

personal identification number (PIN) authentication system.

Offline Debit System: Offline debit system may be subject

to a daily limit. Transactions conducted with offline debit cards, require 2-3

days to be reflected on user’s account balances.

Advantages of Debit Cards:

·

There

is no need to carry cash

·

It

is quick and less complicated than using a cheque.

·

It

can be used for withdrawals of cash.

·

It

can be issued to any individual without assessing credit worthiness.

·

Its

holders can have a record of the transactions in his bank statement which will

enable him to plan and control the expenditure.

7.

Electronic Wallet/Purse

A digital/electronic wallet refers to

an electronic device that allows an individual to make electronic commerce transactions. This can include

purchasing items on-line with a computer or using a smartphone to purchase

something at a store.

Increasingly, digital wallets are

being made not just for basic financial transactions but to also authenticate

the holder's credentials. For example, a digital-wallet could potentially

verify the age of the buyer to the store while purchasing alcohol.

It is useful to approach the term

"digital wallet" not as a singular technology but as three major

parts: the system (the electronic infrastructure) and the application (the

software that operates on top) and the device (the individual portion).

An individual’s bank account can also

be linked to the digital wallet. They might also have their driver’s license,

health card, loyalty card(s) and other ID documents stored on the phone. The

credentials can be passed to a merchant’s terminal wirelessly via near field

communication (NFC).

Certain sources are speculating that these Smartphone “digital wallets” will

eventually replace physical wallets.

A digital wallet has both a software and information

component. The software provides security and encryption for the personal

information and for the actual transaction.

Typically, digital wallets are stored on the client side and

are easily self-maintained and fully compatible with most e-commerce Web sites. A server-side digital wallet, also known as a

thin wallet, is one that an organization creates for and about you and

maintains on its servers. Server-side digital wallets are

gaining popularity among major retailers due to the security, efficiency, and

added utility it provides to the end-user, which increases their enjoyment of

their overall purchase.

Advantages of Electronic Payment System

·

Decreasing Technology cost

The technology used in the networks

is decreasing day by day, which is evident from the fact that computers are now

dirt cheap and Internet is becoming free almost everywhere in the world.

·

Reduced operational and processing

cost

Due to reduced technology cost the

processing cost of various commerce activities become very less. A very simple

reason to prove this is the fact that in electronic transactions we save both

paper and time.

·

Increasing online commerce:

The above two factors have lead many

institutions to go online and many others are following them.

Drawbacks

or Risks in Electronic Payment System

Electronic payment is a popular method of making

payments globally. It involves sending money from bank to bank instantly --

regardless of the distance involved. Such payment systems use Internet

technology, where information is relayed through networked computers from one

bank to another. Electronic payment systems are popular because of their

convenience. However, they also may pose serious risks to consumers and

financial institutions.

·

Tax Evasion

Businesses are required by law to

provide records of their financial transactions to the government so that their

tax compliance can be verified. Electronic payment however can frustrate the

efforts of tax collection. Unless a business discloses the various electronic

payments it has made or received over the tax period, the government may not

know the truth, which could cause tax evasion.

·

Fraud

Electronic payment systems are prone to fraud. The

payment is done usually after keying in a password and sometimes answering

security questions. There is no way of verifying the true identity of the maker

of the transaction. As long as the password and security questions are correct,

the system assumes you are the right person. If this information falls into the

possession of fraudsters, then they can defraud you of your money.

·

Impulse Buying

Electronic payment systems encourage impulse buying,

especially online. You are likely to make a decision to purchase an item you

find on sale online, even though you had not planned to buy it, just because it

will cost you just a click to buy it through your credit card. Impulse buying

leads to disorganized budgets and is one of the disadvantages of electronic

payment systems.

·

Payment Conflict

Payment conflicts often arise because the payments are

not done manually but by an automated system that can cause errors. This is

especially common when payment is done on a regular basis to many recipients.

If you do not check your pay slip at the end of every pay period, for instance,

then you might end up with a conflict due to these technical glitches, or

anomalies.

E-Commerce Notes

Unit-2

Lecture-8

Extranet

·

Extranet

is an extended intranet that connects multiple intranets through a secured

tunneling internet.

·

Extranets

act as a link to select individuals outside the company by allowing them access

to the information stored inside the intranet.

·

Internet

protocols are typically utilized by extranets so as to provide browser

navigation even though the network is situated on a private server. A username

and password system can be configured to sectors of the content so as to

prevent users from accessing information they have no authorization for.

·

Extranets

combine the privacy and security of intranets with the global reach of the

internet, granting access to outside business partners, suppliers, and costumers

to a controlled portion of the enterprise network. Extranets are becoming the

major platforms for B2B EC replacing or supplementing EDI. They provide

flexibility serving internal and external users.

Extranets

generally have the following features:

Ø The use of Internet technologies and standards. These include the standardized techniques for

transmitting and sharing information and the methods for encrypting and storing

information, otherwise known as the Internet Protocol, or IP.

Ø The use of Web browsers. Users access extranet information using a web

browser like Microsoft Internet Explorer, Netscape Navigator or, more recently,

Mozilla’s Firefox. Browser software uses relatively small amounts of memory and

resources on a computer. The great thing about browsers is that an application

written for a browser can be read on almost any computer without regard to

operating system or manufacturer. That makes an application developed for a

browser a snap to deploy. A browser on a user’s machine is all the software he

or she needs to take full advantage of the extranet application. No messy and

confounding installation disks; fewer clogged hard drives.

Ø Security. By

their very nature, Extranets are embroiled in concerns about security. To

protect the privacy of the information that is being transmitted, most

Extranets use either secure communication lines or proven security and

encryption technologies that have been developed for the Internet.

Ø Central Server/Repository. Extranets usually have a central server where documents

or data reside. Members can access this information from any computer that has

Internet access.

While these are the broad attributes shared by

most Extranets, Extranets vary dramatically in their design and implementation.

They can be employed in a wide variety of environments and for very different

purposes, like:

- Sharing

case information

- Sharing

of case-related documents—many Extranets contain document repositories

that can be searched and viewed by both lawyer and client on-line

- Calendaring—key

dates and scheduling of hearings and trials can be shared on-line

- Providing

firm contact information

- Acting as a “work flow engine” for various

suppliers

- Providing access to firm resources remotely

- Sharing time and expense information.

Extranet applications Case

An extranet application is a software data application that

provides limited access to your company's internal data by outside users such

as customers and suppliers. The limited access typically includes the ability

to order products and services, check order status, request customer service

and much more.

A properly developed extranet application provides the supply chain connection needed with customers and suppliers to dramatically lessen routine and time consuming communications. Doing so frees up resources to concentrate on customer service and expansion as opposed to administrative office tasks such as data entry.

Just as intranets provide increased internal collaboration, extranets provide increased efficiencies between your company and its customers and/or suppliers. Developing and implementing an extranet application can provide you the competitive edge to stay ahead of the competition in the eyes of your customers and a better ability to negotiate prices with your suppliers.

A properly developed extranet application provides the supply chain connection needed with customers and suppliers to dramatically lessen routine and time consuming communications. Doing so frees up resources to concentrate on customer service and expansion as opposed to administrative office tasks such as data entry.

Just as intranets provide increased internal collaboration, extranets provide increased efficiencies between your company and its customers and/or suppliers. Developing and implementing an extranet application can provide you the competitive edge to stay ahead of the competition in the eyes of your customers and a better ability to negotiate prices with your suppliers.

Potential of Extranet Market

Internets are included in extranets, the forecasted potential

of extranets is frequently combined with that of the intranets. According to a

study by Gartner Group, Extranets are expected to be a platform of choice of

more than 80 % of B2B EC. This increasing acceptance is expected to surpass B2C

EC which is also expected to be conducted across intranets, by about 40

percent. Most of the B2C EC traffic will be done on the regular internet.

However many companies, such as FedEx, will allow costumer to enter their

intranets.

Planning Extranet

If you are considering introducing an intranet

or extranet into your business, you should ensure that it is flexible enough to

meet not only your immediate requirements, but also your needs as your business

grows. Make sure your objectives are clear. Will you restrict access to your

site, or will you allow all of your customers to use it? Do you want to promote

flexible working in your business by catering for your remote workforce? How

will you measure the success of your investment?

Identify the information that will need to be

made available in order to meet your objectives:

- What

kind of company information do you need on your intranet? For example,

company policies, news, forms and corporate branding.

- Do

you need to make all of your production and sales information available to

your partners via your extranet, or will discrete sub-sections be

sufficient?

- Web

server hardware and software. The size of the server will depend on the

number of potential users and whether or not you will need a lot of

bandwidth to support audiovisual content, eg video feeds.

- Computers

connected via a local area network - a closed, private network.

- Firewall

software and hardware, which will prevent unauthorized access from outside

your organization.

- A

content management system to add and update intranet content.

This might be a good arrangement if your

business is just starting up - you can develop your own intranet once your

business has grown and you have more funds available. Once you have your

intranet up and running, you can create your extranet by giving partners access

to the necessary company data via a log-in page. Identify the support costs

that will be required to run the site on a day-to-day basis. Will you require

technical support - if so, at what level? You should also consider how the

content will be managed. Remember that security is paramount, since any

security incident will directly affect not only you but also your key business

partners. You should establish what levels of security are provided when

choosing a technology solution.

Advantages/Benefits of Extranet

Ease of set-up, use

and maintenance: Extranets should be simple to set-up, use and

maintain. The time it takes to develop a complete and functioning extranet with

a robust Web-standard software solution amounts to days or weeks, rather than

months or years with proprietary networks solutions. Modifications can also be

implemented with little or no interruption to the extranet’s activities.

Scalability: Extranets

require the flexibility to grow to include additional users or organizations,

or to expand to a new hardware server array without compromising the system's

usability or integrity. Solutions written using non-industry standard format or

proprietary architectures can significantly restrict an extranet's ability to

scale to include new users, applications, servers or other components. Extranet

solutions eliminate the lock-in strategies used by software vendors and allow

for greater extensibility of the extranet to meet the growing and changing

demands of the on-line user community.

Versatility: An extranet

should serve fundamental business activities such as document exchange,

collaborative discussion groups, on-line submission forms, database queries,

etc. yet have the ability to be customized to satisfy a particular business

purpose. For example, companies transferring text or document files have

different requirements than those that transfer movies, video clips, other

multimedia files to be viewed on-line. Some organizations may wish to sell

directly on-line through the extranet and others may wish to only automate the

back office operations. Regardless of the business objective, extranets require

versatility to accommodate a dynamic company's changing mission, goals and

objectives.

Security: Security is

perhaps the single most important characteristic possessed by an extranet that

serves multi-organizational interests. Ensuring that all participant and

contributor content is protected within a secure and accountable framework

provides the basis for system usability and dependability. Although no system

is ever 100% secure, recent advances in security technology provide extranets

with security that exceeds industry standards and protects on-line information

and intellectual property.

Business Models of Extranet Applications

The extranet represents the bridge between the public

Internet and the private corporate intranet. The extranet connects multiple and

diverse organizations on-line, enabling strategic communities of stakeholders

with common interests (communities of interests) to form a tight business

relationship and a strong communication bond, in order to achieve

commerce-oriented objectives. The extranet defines and supports this extended

business enterprise including partners, suppliers and distributors,

contractors, customers and others that operate outside the physical walls of an

organization but are nonetheless critical to the success of business

operations. With the Internet providing for public outreach or communication,

and intranets serving internal business interests, extranets serve the

business-critical domain between these extremes where the majority of business

activity occurs.

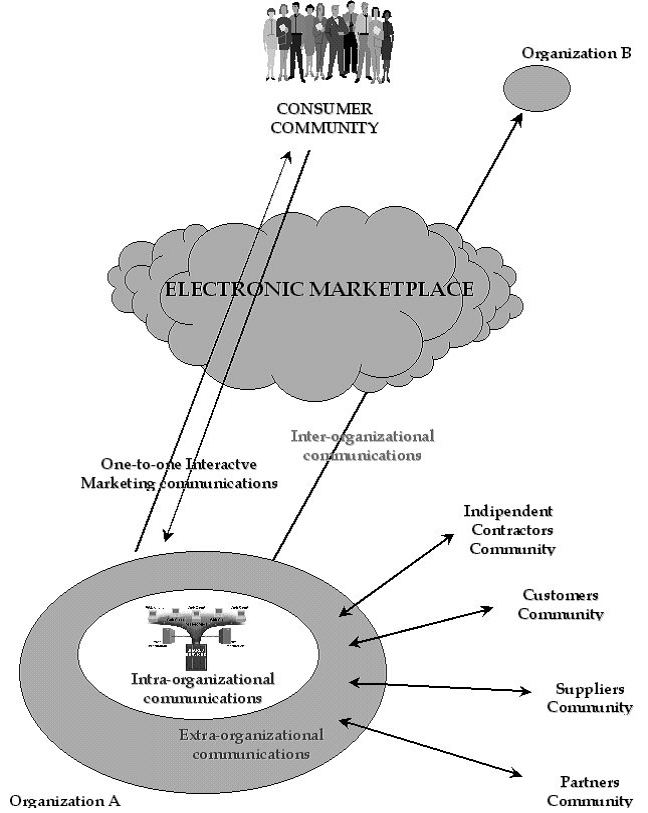

Fig: Business Model for

Extranet

The unification of robust enabling technologies and

ubiquitous access through the Web is resulting in unique and interesting market

dynamics that are changing the way many companies are doing business.

Interactive communities are beginning to emerge that exist

solely in cyberspace, where information travels faster, more cost effectively,

and with greater accuracy when compared to other forms of communication and

information exchange. These interactive communities are the driving and

sustaining force behind the extranet concept, and their insatiable collective

need to access content when, where, and how they want to see it will continue

to push the limits of what is technologically possible. Extranet solutions

built to engage and support these interactive communities are designed to

emphasize and foster customer relationships. As successful businesses know, the

cost of obtaining a new customer far outweighs the cost of maintaining a

current one.

With commerce-enabled extranets, companies are now able to

establish and maintain one-to-one relationships with each of their customers,

members, staff or others at very low cost through the Web, offering a

customized and individualized experience that can be dynamically generated or

modified based upon a user's privileges, preferences, or usage patterns.

Information entered by the user (registration form, on-line surveys, etc.) can

be compiled with statistics and other information that is captured

automatically by the system (searches performed, products purchased, time spent

in each site area, etc.) to provide the company a complete picture for each and

every visitor of the system. This comprehensive user profile offers

unprecedented opportunities to present relevant information, advertising,

product and service offerings and other content to a qualified, targeted

interactive user community on a one-to-one basis.

Fig: Interaction of

consumer community and Organization

Managerial

Issues

Management is no longer worries about

whether or not to adopt the intranet/ extranet but is concerned about how to

utilize them successfully for business.

Intranets/ Extranets are already two facts of life in many large

corporations. Thus management needs to review it’s own company’s position in

dealing with a verity of issues in installing the internet/ extranet. The

following are the guidelines for managerial issues:

1.

Find the business opportunities by

utilizing the intranet and extranet: for example, consider connecting the customer, suppliers

and internal branches that are geographically dispersed.

2.

Analyze whether the connectivity

requirement suits the intranet and extranet: it is mainly dependent upon whether the network is

composed of one LAN or multiple LANs. The former is suitable for internet and

the latter for extranet. Individual’s remote access should also be considered.

3.

Plan the most secure economical

choice for implementation: consult the technical persons and outside the company for

implementation. Review the current proprietary or leased network and determine

if it can be replaced by intranet and extranet. It may reduce costs and widen

connectivity for the customers and suppliers.

4.

Select the best outsourcers for

implementation:

compare the outsourcers who can implement the internet/ extranet. The extranet

solution providers can cultivate new opportunities in this big market.

5.

Selling the intranet: corporate intranet can serve as a

wonderful pool, where employees can do many things ranging from taking classes

to updating benefit plans. Too often employees are not using the intranet to

its fullest capacity. Businesses are exploring innovative ways to market their

intranet to their employees. For example some companied are making presentation

to employees, other give prizes, yet other created an “Intranet Day”.

great post about e-commerce get the best E-commerce development noida

ReplyDeleteGreat post.

ReplyDeletehttp://www.folkd.com/user/RaghibFadi

Great post.

ReplyDeletehttps://www.question2answer.org/qa/user/AdliMajid

Great post.

ReplyDeletehttps://archive.org/details/@michaelthompson

Great post.

ReplyDeletehttps://wiseintro.co/virohaa

Great post.

ReplyDeletehttps://forum.freeadvice.com/members/steven-s-wendt.706452/#about

Great post.

ReplyDeletehttps://www.diyaudio.com/forums/members/blakebankston.html

Like the written by hand signature, which approves physical reports, electronic records can be approved by marking them utilizing an advanced mark. Vakilsearch site to get Class 3 digital signature

ReplyDeleteGreat article! Thanks for sharing an informative blog with us. I learn many new things from your article. I really like your post, It is very helpful for us. Please keep sharing these types of articles.

ReplyDeleteFantasy Sports App Development

Thanks for the information, click here to class 2 digital signature online

ReplyDeleteScale up your business with the CreditQ 2.0. Join CreditQ and progress towards your goal with the Business Credit Management services

ReplyDeleteThanks for sharing this post with us.Wikivela

ReplyDeleteUnit 2, Lecture 1 on e-commerce notes provides valuable insights. It covers fundamental concepts crucial for understanding the digital marketplace. Why Can't Support From transaction security to customer experience.

ReplyDelete